In Washington state, the Legislature is in special session, negotiating a budget deal. The state desperately needs funding for our schools, as the state Supreme Court has ruled that the Legislature is failing our children.

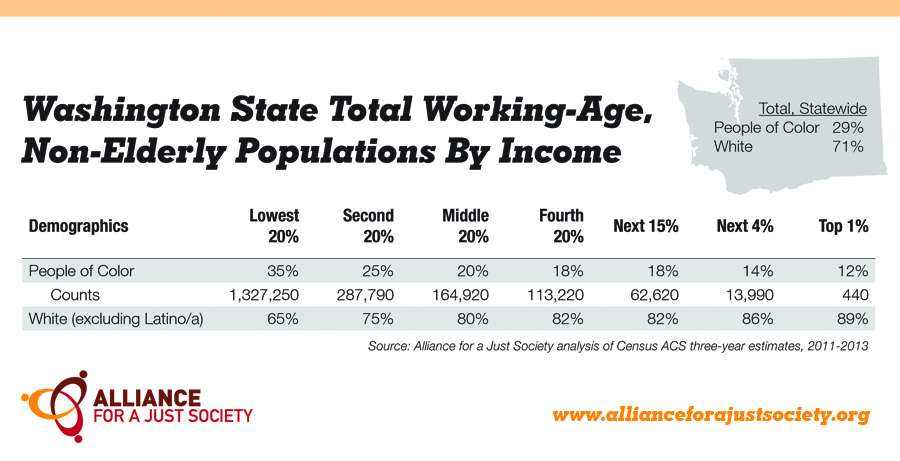

Meanwhile, Washington has the most inequitable tax structure in the country, which means those with the most ample resources pay the least in covering the costs of vital public services like education and health care. Look at this jaw-dropping graph:

Alliance analysis of Census Bureau data shows that the higher up the income scale you go, the fewer people of color you see. That means the lowest-income Washingtonians, with a disproportionately higher share of people of color, are the ones paying the most for public resources that benefit all.

To further understand the racial equity implications of the state budget, read my piece in the Seattle Globalist that explains how Washington’s revenue structure enables a system of economic racism.

What can we do about this? Washington is also just one of nine states in the country that does not tax stock market profits. There is a proposal on the table through the House budget to enact a capital gains tax on our very wealthiest to help fund education and other important public goods. This would simultaneously raise badly needed revenue while bringing more balance to Washington’s backward revenue system.